As a Managing General Agency and insurance company, we strive constantly to educate our customers – the community manager, business owner, property owner, etc. — on providing a safer environment for workers and customers and save money at the same time. That may sound a bit strange for an insurance company to say, but it all goes back to the basics of insurance. Insurance by definition is “a contract whereby, for specified consideration, one party undertakes to compensate the other for a loss relating to a particular subject as a result of the occurrence of designated hazards,” Furthermore, a hazard is a “condition or situation that creates or increases chance of loss in an insured loss.”

You are probably asking yourself, “What does this have to do with saving money?” Unfortunately, an insurance company does not have a printing press in the basement to pay claims and expenses at will. It charges a premium for the policy in order to pay claims that are covered by the policy. It obtains funds from the premiums it charges its customers and through investment income. Then, it pays claims and operating expenses. Any remainder is for profits, or losses (if a deficit).For instance, if you have a claim that is covered by your policy, we will promptly handle the claim in accordance with the terms and conditions of your policy. After all, that is why you bought it. In the aftermath of a claim, however, and depending on the factors involved, we may take four different actions: (1) do nothing, (2) change the terms of the coverage (such as an increased deductible or removal or limitation of coverage), (3) increase premiums, or (4) cancel or non-renew the policy.

The key point in all of this is that you have a significant stake as a business owner in your insurance costs, your insurability, and whether or not a claim occurs. The claim can cost you money and directly affect your bottom line with increased premiums or difficulty finding an insurance company that will insure your business, especially if there are multiple claims during the life of a policy.

So how can you save money? In the very competitive Florida insurance marketplace, a typical business, association, or community with little or no claims history is very attractive to an insurance company. Insurance companies compete by charging prices that reflect your loss history, among other things. If your loss history is attractive to the insurance company, in many cases they will make their policy more attractive to you and your agent by lowering rates, giving you better coverage terms, or both.

So how do you avoid a claim? We previously defined what a “hazard” is, but it’s also important to note that there are two types of hazards:(1) uncontrollable hazards that you can’t do much about, such as lightning or tornados, and (2) controllable hazards that you can do a lot to reduce, such as removing trip hazards from the premises or making sure your building’s roof is maintained and in good condition. You can’t do much about the uncontrollable hazards except protect yourself by purchasing insurance, but you can do a lot about controllable hazards. For example, trip and fall hazards (or, in insurance jargon, Premises Liability Hazards) are the most frequent type of claim that businesses experience – and often the most expensive. How are these claims controllable? While at your business, some people may trip and fall over their own two feet, which is something you really can’t prevent. However, more often than not, tripping and/or falling are caused by an existing hazard that a customer, worker, or resident must negotiate. These losses are controllable, as you can remove and eliminate the hazard, or you can warn and educate the individual about the hazard.

The most common surface that people trip and fall on is the walking surface. A walking surface can be inside or outside of your business/operation. For example, the photo below shows a typical sidewalk with an uneven surface. In this case, a tree root has pushed up the sidewalk and created a hazard, so the section of sidewalk should be replaced or ground down to smooth and even the surfaces.

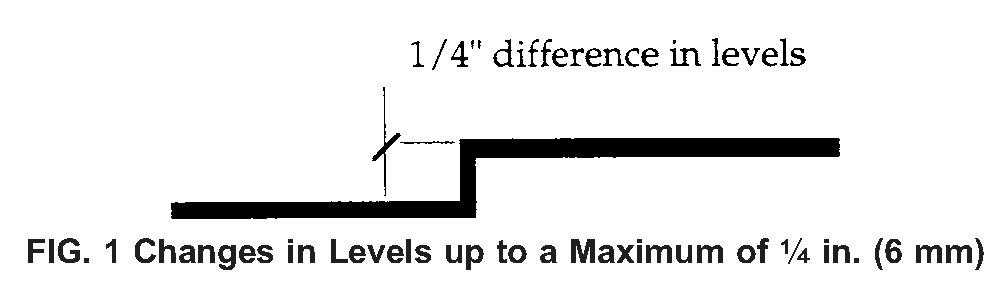

The standard used by the legal community in a premises liability case is the difference in level from one surface to another should not be more than a quarter of an inch.

If carpet is loose or damaged, it too can be a hazard. In this case, the carpet should be removed and new carpet installed in its place.

Obstacles in the way of a pedestrian are also a hazard. Removal of the parking stop and installation of bollards in its place would be the best outcome in this case.

Anytime there is a change in the elevation of a walking surface, it’s a good idea to warn people that a change is coming. One way to do this is with yellow paint, as shown below.

Signs can also be used to warn and educate the user about potential hazards.

In summary, it’s all about common sense, awareness, and commitment to running a safe operation. Control your losses by inspecting your premises and removing hazards that can cause an injury and resulting claim. This should be done on a regular basis, as hazards, can appear quickly and without warning.

If you have need assistance in identifying hazards or what to do about them, please feel free to use our safety checklist, or have your agent contact Tower Hill’s Commercial Lines department. We want to help you create a safe business environment and save yourself some money that will contribute to your bottom line!