Ever wonder where the phrase “window of opportunity” comes from? Time magazine may have been the first to use the phrase in its November 12, 1979, issue to describe a small space or short period to get something accomplished. A “window” exists in our underwriting process where we can grant extensions for our agents and insureds to complete a task or request, and other times when the deadline cannot be amended.

Tower Hill reviews each application after it is bound. Our risk underwriting team reviews applications, inspections, 4-points, wind mitigation forms, and more within the first 30-45 days after the policy is submitted.

During this review, we may discover:

- We need more information. Example: the application lists unmarried insureds and one of them isn’t on the deed. Without comments on the application, we send a diary to the agency to find out the relationship and occupancy of the applicants.

- There is missing information. Example: the home was built in 1962 and there is no attached 4-point inspection.

- Adverse conditions exist. Example: the inspection indicates there is a broken window that needs to be replaced.

What happens next usually follows a three-step process:

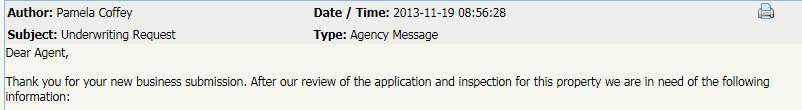

Step 1: The risk underwriter reviews the application and determines they need additional information. They diary the agency using the Rating and Policy Management (RPM) system:

We specify a date when we need a response. The time is based on the circumstances and is somewhat flexible, if needed (by statute, we have 90 days from the policy effective date to accept or reject an application for coverage – our window of opportunity). This is the time to contact your underwriter if you need more time or clarification on the request.

Step 2: If we do not receive information by the specified deadline, the underwriter will take action on the policy, including possible cancellation. Your agency will receive a Notice of Cancellation (NOC) in our RPM system. The NOC will specify the exact reasons the policy will cancel. We allow three additional days for you to contact the insured and underwriting. This is your last opportunity if you need additional time or information about our underwriting activity.

Step 3: If we do not receive any new information after three days, a cancellation is entered into our system. By statute, we provide 20 days before the cancellation goes into effect. This date cannot be amended once it is set; unless there are extenuating circumstances, we cannot offer an extension of time. If the client is unable to remediate the conditions or provide the requested information by the cancellation date, the policy will cancel.

As your agency’s partner, we work hard to keep lines of communication open. You can respond to diary requests in RPM, or you can contact your account underwriter via phone or email. By responding quickly within the “window of opportunity,” we can address any issues and ensure we are underwriting the right risks at the right rates.